Tax seminars

and language courses

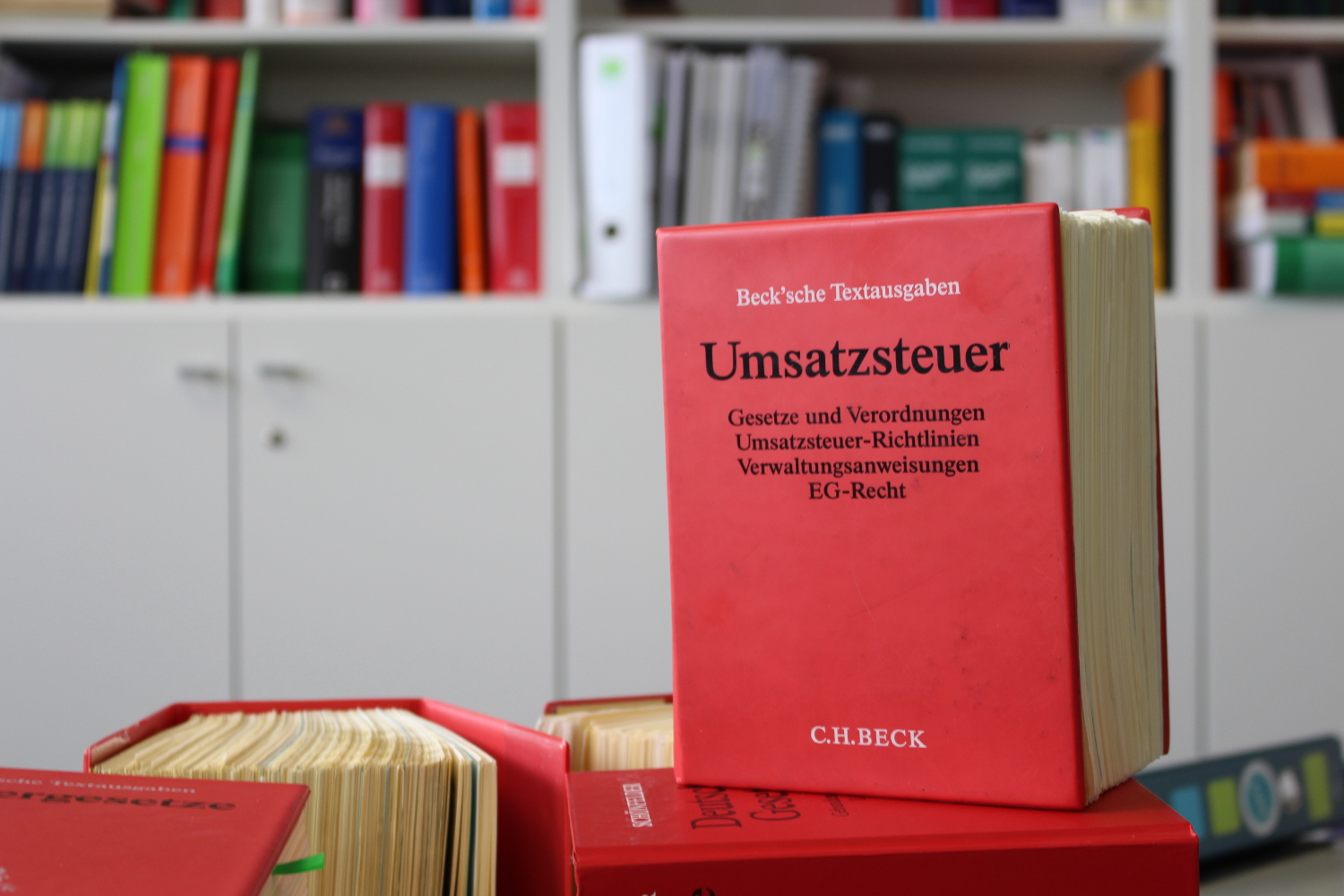

VAT Seminars

offered by the leading provider in Karlsruhe, Pfinztal and Bretten

The professional competence and extensive teaching experience of our lecturer guarantee the success of our training seminars. Theoretical explanations on the VAT are accompanied by practical examples. Real cases and special features, routine situations and exceptions are presented in a simple, clear and comprehensive manner.

Based on your individual questions we show you possibilities to solve VAT related problems in a sure and efficient way.

Together we will open the seven seals of the VAT book.

Why us?

Leading Provider

The Beißwenger Academy has been the leading provider of the region for many years

Experience

Our own continuing training and our extensive teaching experience guarantee your success

Theory and Praxis

We provide not only the necessary theoretical knowledge but also the practical ability for its application

Individual

We schedule enough time for your individual questions during the seminar.

Safe Handling

After attending our seminar, you will meet the daily tax challenges confidently

Next Seminars

Provider:

Beißwenger Academy in Karlsruhe

Date:

Advanced Training Course: Balance Tax Law

2023

The exact date will be communicated in time.

Seminar: VAT – Basics for beginners

2023

The exact date will be communicated in time.

Seminar: VAT for advanced users

2023

The exact date will be communicated in time.

Advanced Training Course: Sales Tax

2023

The exact date will be communicated in time

Advanced Training Course: Income Tax

2023

The exact date will be communicated in time

Lecturer:

Armin Beißwenger, Graduate in Tax Administration

Lawyer